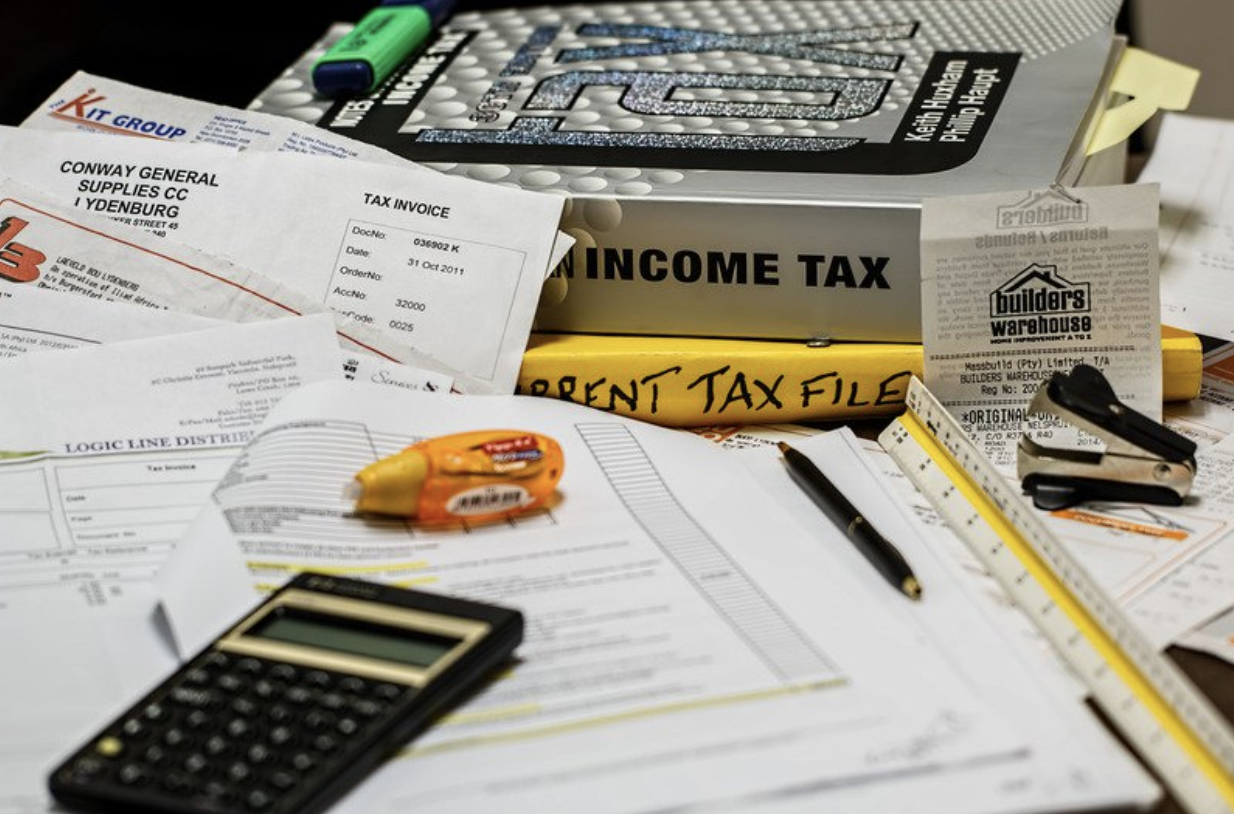

travel nurse taxes in california

If you worked 50 out 52 weeks in 2021 and your base pay hourly rate was 67 and your weekly travel stipend was 1085 you would have a total. Rita is a travel OR nurse who lives in Glendale CA.

Mailing Address Travel Nurse Mailing Address State Tax Agencies

If you were working as a Staff Nurse you would typically be unable to write off housing travel or food expenses on your taxes.

. Simply put your tax home is the state where you earn most of your nursing income. Travel Nurse non-taxable income. You can reach us at 800-884-8788.

But it is pretty close. Bill rates can vary by as much as 20 per hour within the same city. Estimated taxes or quarterly taxes should be 25 of the tax you expect to owe for the year.

Ask Your Own Tax Question. One of the primary terms you will hear when filing your taxes as a traveling nurse is tax home. This is the most common Tax Questions of Travel Nurses we receive all year.

You will also need to pay estimated taxes since there are no tax withholdings for independent contractors. Under the effects of the COVID-19 outbreak the healthcare world is facing unprecedented challenges and the financial landscape is changing quickly. Travel nurse taxes are due on April 15th just like other individual income tax returns.

Travel Nurse Tax Pro based in southern California is an experienced tax preparation firm that focuses on preparing tax returns for travel nurses and other mobile healthcare professionals. 2021 has been a unique year for travel nurses and some pay packages were different. Earning 2100 per week sounds better than 1800 per week but if the former job contract is 40 hours each week and the latter is only 20 hours a week ask yourself if you really need the extra 300.

But it can also have among the worst. California one of the most sought-after states because of the diverse culture fun outdoor activities including swimming in the Pacific Ocean or sipping wine in the Napa vineyards is the ideal place to take a travel nursing assignment. FREE YEARLY TAX ORGANIZER WORKSHEET.

She returns every summer to work at the same local hospital there. To make matters worse travel nurse taxes are probably the most challenging and disliked part about travel nursing. This is because travel nurses are paid a base hourly rate that is taxable and a weekly travel stipend that is not taxable both of which equal their total pay in a given contract.

1 A tax home is your main area not state of work. Travel nursing is an exciting opportunity to see parts of the United States while making some serious money. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable.

In California the bill rates can vary dramatically. Number of Hours. Just that I need someone who consult on travel nursing tax questions.

ED - Emergency Department. FEDERAL AND STATE TAX. Job Description Requirements.

FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. Although your recruiter will most likely give you direction when it comes to taxes they probably only know very basic. Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes.

From tax homes to tax audits heres how travel nursing taxes work and how you can make sure you reap the greatest rewards. Tax-write offs are a unique ability of Travel Nurses and other Allied Pros but this benefit depends on your ability to prove that you have a tax home. But many states including California use a percentage based approach to figuring out taxes due plus different personal exemptions so it may not be exact per my first sentence.

The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Everyone has to have somewhere to live and something to eat but since that financial burden may be double for traveling workers the cost is alleviated through.

And though doing your taxes may seem less urgent in this landscape COVID-19 will impact your taxes too. 2020 TAX GUIDE FOR TRAVEL NURSES 2 2020 is a year like weve never seen before. USSI is seeking a travel nurse RN ED - Emergency Department for a travel nursing job in Lodi California.

Estimated tax payments for the 2022 tax season are due. Deciphering the travel nursing pay structure can be complicated. Travel nurse tax question.

You will often hear people assert that California has the best pay rates for travel nurses. Dont just look at the weekly rate for your travel nurse salary in California but also break it down by hours. Hi travel nurse tax question JA.

Make sure you qualify for all non-taxed per diems. Job Description Requirements. In most states bill rates tend to hover within a decent range.

USSI is seeking a travel nurse RN ED - Emergency Department for a travel nursing job in Upland California. Taxes and travel nursing can be very complicated so its best to consult an accountant for assistance. Basically only income earned in California is taxed there.

Not just at tax time. For example if you live in Arizona and take a nursing job in Oregon that lasts for several months your tax home might end up being Oregon rather than. Travel Nurse Tax Pro has simplified the process to efficiently gather the information necessary to complete your return accurately without burdening.

Keep all receipts related to your expenses as a travel nurse. Get in the habit of logging expenses daily. Mar 03 2021.

Just a few quick questions to understand your situation. I could spend a long time on this but here is the 3-sentence definition. Next talk to an American Traveler recruiter about our Tax Advantage Plan which keeps more money in your paycheck every week - adding up to 10000 a year for some travelers.

For the rest of the year shes a travel. The Accountant can help.

7 Things To Know About Travel Nursing Company Profit Margins Bluepipes Blog

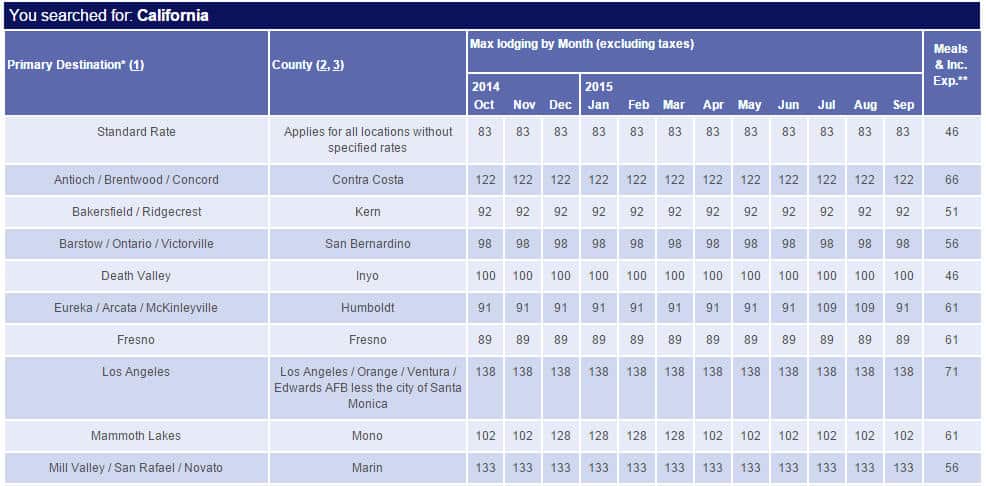

6 Things Travel Nurses Should Know About Gsa Rates

Travel Nursing Tax Guide Wanderly

Tax Tips And Deduction Guide For Nurses In The Us

Travel Nursing At California Kaiser Hospitals Bluepipes Blog

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

6 Things Travel Nurses Should Know About Gsa Rates

How Long Can A Travel Nurse Stay In One Place Bluepipes Blog

6 Things Travel Nurses Should Know About Gsa Rates

Pros And Cons Of Accelerated Nursing Programs Nursing Programs Nursing School Nursing School Scholarships

Travel Nursing Tax Guide Wanderly

Travel Nursing Tax Guide Wanderly

I Took Crappy Travel Nurse Pay How To Calculate Travel Nurse Pay Packages Detailed Youtube

Travel Nursing Tax Guide Wanderly

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Travel Nursing Tax Guide Wanderly

6 Things Travel Nurses Should Know About Gsa Rates

How Long Can A Travel Nurse Stay In One Place Bluepipes Blog